1/5

e-IVA - Declaracion Propuesta

1K+Downloads

5.5MBSize

1.1.10(14-07-2020)Latest version

DetailsReviewsVersionsInfo

1/5

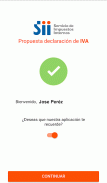

Description of e-IVA - Declaracion Propuesta

E-VAT information

The Internal Revenue Service puts the e-VAT app at your disposal, a new application that will allow you to declare and pay Form 29 in an easy, safe and free way.

Using the e-VAT app you can:

1. Validate and send your Declaration.

2. Complement information in the assistants (Sales and Service Tickets, Electronic Fees Ballots and Third Party Services Provision Tickets)

3. Postpone the Payment of VAT

4. Pay with Online Payment (PEL)

5. Check the status of your Declaration

e-IVA - Declaracion Propuesta - Version 1.1.10

(14-07-2020)What's newVersión 1.0.10- Mejoras de rendimiento

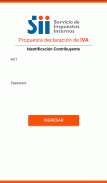

e-IVA - Declaracion Propuesta - APK Information

APK Version: 1.1.10Package: cl.sii.declaracionelectronicaivaName: e-IVA - Declaracion PropuestaSize: 5.5 MBDownloads: 34Version : 1.1.10Release Date: 2024-06-14 08:59:52Min Screen: SMALLSupported CPU:

Package ID: cl.sii.declaracionelectronicaivaSHA1 Signature: 15:B6:5F:10:FB:5A:AD:49:33:6C:DC:0B:67:17:54:34:6C:3A:D8:DFDeveloper (CN): luis urraOrganization (O): siiLocal (L): santiagoCountry (C): CLState/City (ST): santiagoPackage ID: cl.sii.declaracionelectronicaivaSHA1 Signature: 15:B6:5F:10:FB:5A:AD:49:33:6C:DC:0B:67:17:54:34:6C:3A:D8:DFDeveloper (CN): luis urraOrganization (O): siiLocal (L): santiagoCountry (C): CLState/City (ST): santiago

Latest Version of e-IVA - Declaracion Propuesta

1.1.10

14/7/202034 downloads5.5 MB Size